Some ways companies incentivize managers to maximize shareholder value are through financial incentives, non-financial incentives, performance-based compensation, corporate governance mechanisms, culture and values, and alignment with shareholder interests. These strategies aim to align the goals of managers with the interests of shareholders, thereby enhancing the company’s overall performance and value.

Financial incentives, such as stock options and bonuses, provide managers with a direct stake in the company’s success. Non-financial incentives, such as recognition, status, and career advancement, can also motivate managers to focus on long-term value creation.

Financial Incentives

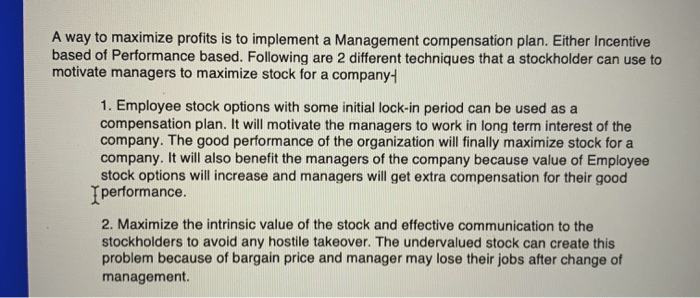

Financial incentives, such as stock options and bonuses, align managers’ interests with shareholder value by providing them with a direct stake in the company’s financial performance. Stock options grant managers the right to purchase shares of the company at a fixed price, allowing them to benefit from any increase in the stock price.

Bonuses, tied to specific performance targets, reward managers for achieving desired financial outcomes.

However, excessive financial incentives can lead to short-term thinking and risk-taking as managers prioritize immediate financial gains over long-term shareholder value.

Non-Financial Incentives

Non-financial incentives, such as recognition, status, and career advancement, can also motivate managers to focus on shareholder value. Recognition and status, through awards or public acknowledgment, boost managers’ morale and self-esteem, encouraging them to perform at their best. Career advancement opportunities, such as promotions and increased responsibilities, provide managers with a clear path for growth and development, incentivizing them to align their actions with the company’s goals.

Performance-Based Compensation

Performance-based compensation structures directly link managers’ pay to the company’s performance. Profit-sharing plans distribute a portion of the company’s profits among managers, rewarding them for overall financial success. Return on investment (ROI) bonuses, on the other hand, incentivize managers to make decisions that maximize the return on the company’s investments.

| Structure | Pros | Cons |

|---|---|---|

| Profit-sharing | – Aligns managers’ interests with shareholders’ interests

|

– Can encourage short-term thinking

|

| ROI Bonuses | – Encourages managers to make investment decisions that maximize returns

|

– Can lead to excessive risk-taking

|

Corporate Governance Mechanisms

Boards of directors, composed of both internal and external members, play a crucial role in ensuring managers are focused on shareholder value. Independent directors, not affiliated with the company’s management, provide an objective perspective and challenge management decisions.

Corporate governance mechanisms, such as shareholder activism and proxy contests, allow shareholders to voice their concerns and influence managers’ behavior.

Culture and Values

A company’s culture and values shape managers’ decision-making and behavior. A culture that prioritizes shareholder value encourages managers to make decisions that maximize long-term financial performance. Companies can create such a culture through clear communication of their values, recognition of managers who prioritize shareholder value, and alignment of incentives with shareholder interests.

Alignment with Shareholder Interests: Some Ways Companies Incentivize Managers To Maximize Shareholder Value Are

Aligning managers’ interests with those of shareholders is crucial for maximizing shareholder value. Potential conflicts of interest, such as personal financial gain or career advancement, should be identified and mitigated through clear policies and ethical guidelines. Transparency and accountability measures ensure managers act in the best interests of shareholders.

Essential FAQs

What are the potential drawbacks of excessive financial incentives?

Excessive financial incentives can lead to short-term thinking, excessive risk-taking, and a focus on personal gain rather than long-term value creation.

How do corporate governance mechanisms influence managers’ behavior?

Corporate governance mechanisms, such as boards of directors and independent directors, can provide oversight and accountability, ensuring that managers are focused on shareholder value.

What is the importance of aligning managers’ interests with those of shareholders?

Aligning managers’ interests with those of shareholders helps to reduce conflicts of interest and ensures that managers are working towards the same goals as the company’s owners.